The best strategy for eCommerce success, in what has become the world’s sixth largest economy, is to know the rules of the local online market well – or risk being sidelined. The Brazilian online market is in a league of its own, with very particular legislation and taxation impacting cross-border purchases, capable of posing difficulties to international companies. There’s really no point in attempting to circumvent the local payments rules, regardless of how good your dribbling skills are. Not unless you want to risk punishing and alienating Brazilian shoppers, reducing your revenue to only a fraction of what it could be.

Here’s a short list of the best practices that you need to be aware of when selling in Brazil:

- National cards and local currency support (Brazilian Real)

- Payments in installments

- Taxation

- Boleto Bancario

- Recurring charges retry logic

National cards

The predilection of Brazilian payment methods over international alternatives, driven by local taxes and legislation, is a key aspect of Brazil’s ecommerce market.

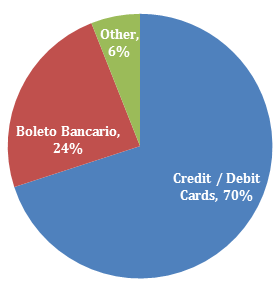

- Brazilian shoppers use credit or debit cards for approximately 70% of online purchases, with e-Bit noting that the number can be as high as 73%.

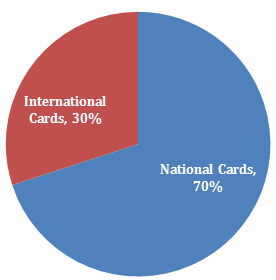

- No less than 80% of cards used are issued by local banks and support only the Brazilian Real (R$).

- Only 20% of cards also support international currencies and can be used for cross-border transactions.

The thing to remember when it comes to cards issued by Brazilian banks is that processing is limited to domestic processors, and a local partnership is vital in opening up the vast Brazilian market to international companies.

Payments in installments – (Parcelamento/Parcelas)

A characteristic of national cards in Brazil, installments – or parcelas – have been deeply rooted in Brazilian commerce long before credit cards were common. Some could say installments are as much a part of the local culture as Samba. In fact, it’s not uncommon in Brazil for a fraction of the total price of products to be advertised, focusing on its single installment value.

- IMF estimates that the use of installments for the purchase of durables is common across at least 70% of households.

- According to Financial Times as many as 80% of all retail sales involve installments.

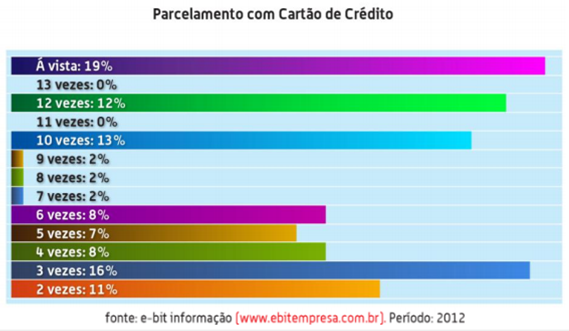

Installments also play a key role for eCommerce transactions, with shoppers taking advantage of parcelamento for 50% of online payments made with credit / debit cards.

- Some 63% of online card payments involve installments, according to e-Bit, which also offered an overview over how transactions are divided into parcelas / individual payments.

Taxation

Brazilian banks started giving payments in Brazilian Reals an advantage over international currencies in September 2013, by declining Dynamic Currency Conversion transactions (DCC). The measure, imposed on local banks, made card transactions in international currencies virtually impossible, with more than 7 out of every 10 DCC transactions failing. However, some 20 to 30% of local cards continue to support transactions in non-BRL currencies. Such payments are punishing Brazilian shoppers and increasing the value of purchases artificially through the addition of taxes. A tourism exchange rate, of as much as 8%, is applied to converting the value of transactions from international purchases into Brazilian Reals. On top of this, there’s another 6.38% Financial Transaction Tax that also increases the price paid by customers. It’s easy to see why international cards and transactions in non-BRL currencies are not a solution for Brazilian online shoppers.

Boleto Bancario

Extremely secure (since there’s virtually no possibility of fraud) and a safe payment method for international companies because of the lack of chargebacks, Boleto Bancario is a very popular alternative to card payments in Brazil. Popular with both B2C and B2B (the preferred method for business customers where it’s used for 100% of payments), Boleto Bancario can contribute to increasing conversion rates. e-Bit reveals that some 18% of ecommerce transactions in Brazil are done through cash payments in combination with the bank transfer, namely a Boleto Bancario. This payment method does come with lower conversion rates (approximately 50%), since they force customers to make physical payments, but there’s absolutely no risk associated with it. By offering support for Boleto Bancario on top of national cards (with installments) and international cards, you cover over 90% of the payments market in Brazil.

Recurring charges retry logic

Almost 60% of Brazilians are paying installment debt on a monthly basis, according to the Brazilian Institute of Economics. These payments added to additional expenses and combined with low credit card limits, can result in scenarios in which recurring charges are denied because of lack of funds. To increase the conversion rate for subscription renewal payments, you need the possibility to customize and adapt the authorization retry logic to produce the best results. Proper scheduling of recurring payments can make all the difference between a lost customer and a renewed subscription.

Selling like a local ecommerce star

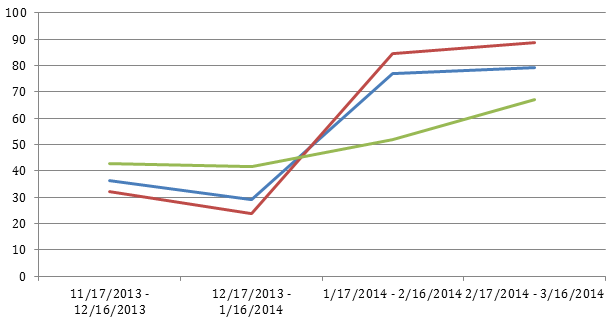

Now that you are aware of some best practices for Brazilian payments, let’s take a look at what a difference it makes to play on the local market following domestic rules. The following graphic summarizes the evolution of conversion rates for three companies that embraced Brazilian national cards over the course of five months. The jump in the conversion rates has secured extra revenue for all companies, increasing it by as much as 200%.

Brazilian sales conversion rate increase following the activation of national cards. Copyright 2014, Avangate.

The jump in conversion rates summarized in the graphic above is the result of applying the best practices detailed throughout this article: providing support for national card with/without installments with payments made in Brazilian Real, avoiding inflating prices artificially through unnecessary taxation, ensuring that Boleto Bancario is a valid payment method, and optimizing the card authorization process.

If you have a presence in Brazil, we’d love to hear your side of the story. Please share your insights in the comments section below.